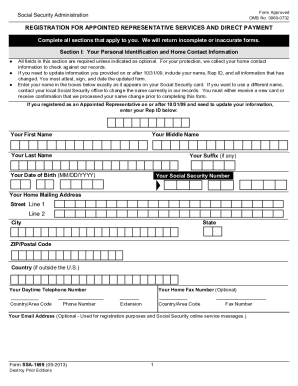

SSA-1699 2024-2026 free printable template

Show details

Complete this form to register as a representative or to update a prior registration with the Social Security Administration.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ssa 1699 form

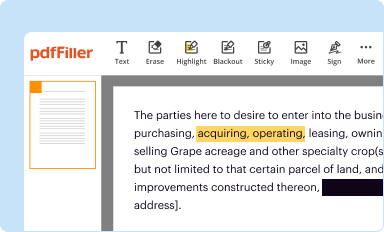

Edit your ssa 1699 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

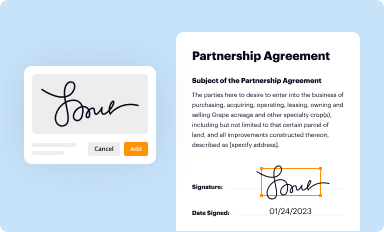

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

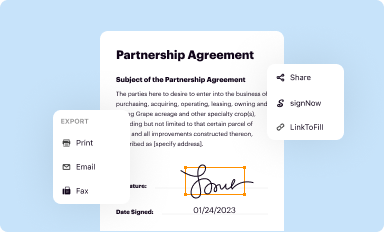

Share your form instantly

Email, fax, or share your ssa 1699 form pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

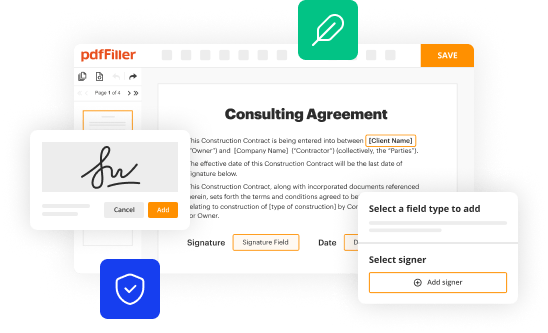

How to edit ssa 1699 online online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ssa 1699 online form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-1699 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ssa form 1699

How to fill out representative registration

01

Obtain the representative registration form from the relevant authority or their website.

02

Fill out the required personal and business information accurately.

03

Provide details about the representative you are appointing, including their contact information.

04

Attach any necessary documentation, such as identification and proof of authority.

05

Review the completed form for accuracy and completeness.

06

Submit the form to the appropriate authority, either online or in person, as per their guidelines.

Who needs representative registration?

01

Businesses operating in a different jurisdiction that require a local representative.

02

Foreign companies looking to conduct business in a new country.

03

Individuals representing a business who need to establish formal recognition.

04

Firms that need to ensure compliance with local laws and regulations.

Fill

ssa form 1699 fillable

: Try Risk Free

People Also Ask about form 1699

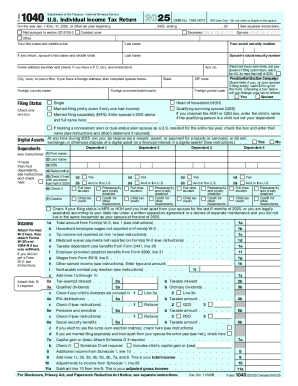

What is the tax table for income?

Tax tables are a tool the IRS provides to make it easy to calculate the exact amount of taxes to report on your federal income tax return when filing by hand. States with state income tax returns also provide tax tables to aid in this portion of the tax preparation process.

Does everyone file a Schedule 1?

Not everyone needs to attach Schedule 1 to their federal income tax return. The IRS trimmed down and simplified the old Form 1040, allowing people to add on forms as needed. You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above.

How do I determine my tax level?

You can calculate your taxes by dividing your income into the portions that will be taxed in each applicable bracket. Every bracket has its own tax rate. The bracket you're in depends on your filing status: if you're a single filer, married filing jointly, married filing separately or head of household.

What is a Schedule 1 for taxes?

Schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

What is a tax table and how does it work?

A tax table is a chart that displays the amount of tax due based on income received. The IRS provides tax tables to help taxpayers determine how much tax they owe and how to calculate it when they file their annual tax returns. Tax tables are divided by income ranges and filing status.

What is the tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)12%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,10032%$170,051 to $215,950$340,101 to $431,9003 more rows • 4 days ago

How do I find my tax table?

You can find the latest tax table which you'll use in 2023 to file 2022 taxes on the IRS' website, specifically its publication named Tax Year 2022—1040 and 1040-SR Tax and Earned Income Credit Tables.

What is the tax table for 2022?

2022 Tax Rates and Brackets Tax RateTaxable Income (Single)Taxable Income (Married Filing Jointly)10%Up to $10,275Up to $20,55012%$10,276 to $41,775$20,551 to $83,55022%$41,776 to $89,075$83,551 to $178,15024%$89,076 to $170,050$178,151 to $340,1003 more rows • Nov 28, 2022

How does the Schedule B work?

The Schedule B code is a U.S.-specific coding system administered by the Foreign Trade Division of the U.S. Census Bureau to track the amount of trade goods that are being exported from the U.S. The Census Bureau tracks the destination country, quantity and dollar amount of exports.

What will the standard deduction be for 2022?

This article has been updated for the 2022 tax year. The standard deduction is a specific dollar amount that reduces your taxable income. For the 2022 tax year, the standard deduction is $25,900 for joint filers, $19,400 for heads of household, and $12,950 for single filers and those married filing separately.

What are the income tax brackets for 2022 vs 2021?

When it comes to federal income tax rates and brackets, the tax rates themselves didn't change from 2021 to 2022. There are still seven tax rates in effect for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. However, as they are every year, the 2022 tax brackets were adjusted to account for inflation.

How do you calculate taxable income on 2022?

Estimating a tax bill starts with estimating taxable income. In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. What's left is taxable income. Then we apply the appropriate tax bracket (based on income and filing status) to calculate tax liability.

What is a Schedule B Code?

The Schedule B is a 10 digit international export code for exporting goods out of the United States (U.S). The Schedule B which is administered by the United States Census Bureau is used to track the amount of trade goods that are being exported from the U.S.

What is a schedule 1?

Schedule I drugs, substances, or chemicals are defined as drugs with no currently accepted medical use and a high potential for abuse. Some examples of Schedule I drugs are: heroin, lysergic acid diethylamide (LSD), marijuana (cannabis), 3,4-methylenedioxymethamphetamine (ecstasy), methaqualone, and peyote.

What is a schedule B?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

What is a Schedule 1 Canada?

Schedule 1 is used to calculate your net federal tax payable (the amount you owe to the federal government) on your taxable income.

Is a Schedule B always required?

It is only required when the total exceeds certain thresholds. In 2022 for example, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 1699 form ssa electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your ssa 1699 form download in seconds.

How do I edit ssa 1699 pdf download straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 1699 form.

How do I complete ssa1699 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your 1699 ssa from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

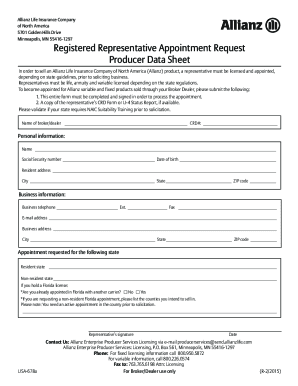

What is representative registration?

Representative registration is a legal process that allows an individual or entity to represent another party in specific transactions or dealings, usually related to regulatory, administrative, or legal requirements.

Who is required to file representative registration?

Individuals or entities such as attorneys, agents, or advocates who wish to officially represent another person or organization in legal matters or dealings are typically required to file representative registration.

How to fill out representative registration?

To fill out representative registration, one must complete the designated registration form with accurate and detailed information regarding the representative and the party being represented, sign it, and submit it to the appropriate authority.

What is the purpose of representative registration?

The purpose of representative registration is to ensure transparency and to legally establish the authority of an individual or entity to act on behalf of another, protecting the interests of all parties involved.

What information must be reported on representative registration?

The information that must be reported generally includes the names and contact details of the representative and the party being represented, the nature of the representation, and any relevant identification or registration numbers.

Fill out your SSA-1699 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 1699 Ssa is not the form you're looking for?Search for another form here.

Keywords relevant to ssa 1699 registration

Related to 1699 ssa form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.