SSA-1699 2013-2024 free printable template

Show details

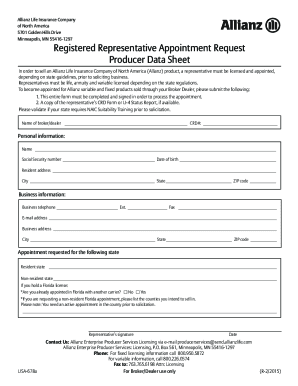

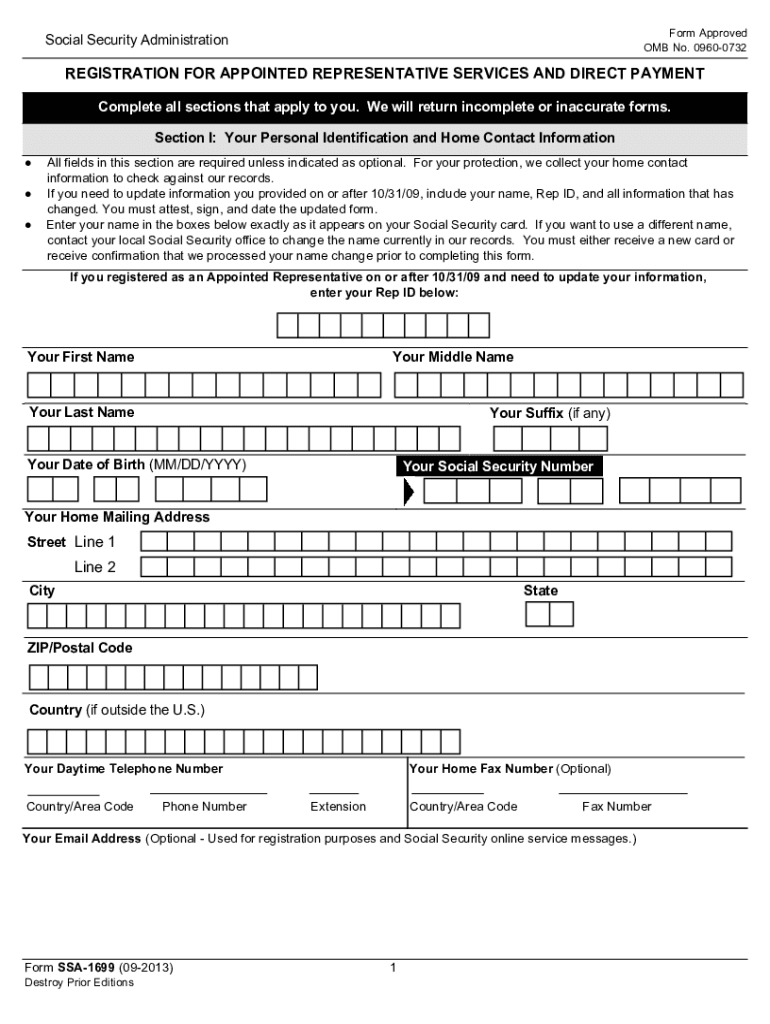

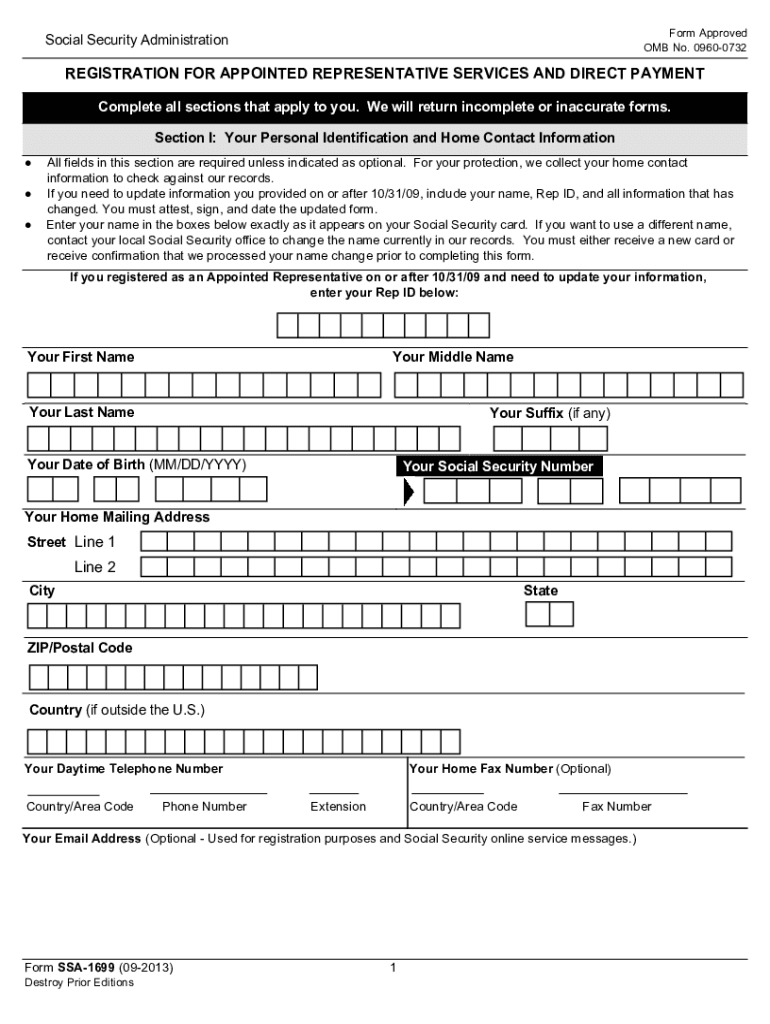

General Information and Instructions Form SSA-1699 at a time. You will receive a notice containing your Representative Identification Rep ID once your initial registration is complete. Socialsecurity. gov/ar. If you are hearing impaired call our TTY number at 1-800-325-0778. You may also visit your local Social Security office. Explanation of Terms for Completing This Form Representative an attorney or individual other than an attorney who meets all of our requirements and is appointed to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ssa 1699 2013-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ssa 1699 2013-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ssa 1699 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ssa 1699 online form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

SSA-1699 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ssa 1699 2013-2024 form

How to fill out schedule tax?

01

Gather all the necessary information and documents, such as your financial records, receipts, and any other relevant documents related to your income and expenses.

02

Review the instructions provided by the tax authority or seek professional guidance to understand the specific requirements for filling out the schedule tax.

03

Start by accurately completing the personal information section, including your name, address, and social security number.

04

Carefully read each line of the schedule tax form and enter the requested information accordingly. Make sure to double-check the accuracy of the data you enter.

05

Calculate any applicable deductions or credits based on the instructions provided and enter them in the appropriate sections of the schedule tax form.

06

Ensure you have properly accounted for all your income sources and accurately report them on the form.

07

Include any necessary attachments or supporting documentation, such as receipts or additional forms, as specified by the tax authority.

08

Review the completed schedule tax form thoroughly to ensure accuracy and completeness.

09

Sign and date the form as required by the tax authority.

10

Submit the filled-out schedule tax form as directed by the tax authority, either electronically or by mail.

Who needs schedule tax?

01

Individuals who have income from various sources, such as self-employment, rental properties, or investments, may need to fill out a schedule tax form.

02

Taxpayers who have deductions or credits that cannot be claimed on the standard tax form typically need to utilize a schedule tax form to accurately report and claim these items.

03

Some taxpayers may be required to fill out a schedule tax form if they meet certain criteria set by the tax authority, such as exceeding a specific income threshold or engaging in certain financial transactions.

Fill ssa 1699 form : Try Risk Free

People Also Ask about ssa 1699

What is the tax table for income?

Does everyone file a Schedule 1?

How do I determine my tax level?

What is a Schedule 1 for taxes?

What is a tax table and how does it work?

What is the tax table for 2022?

How do I find my tax table?

What is the tax table for 2022?

How does the Schedule B work?

What will the standard deduction be for 2022?

What are the income tax brackets for 2022 vs 2021?

How do you calculate taxable income on 2022?

What is a Schedule B Code?

What is a schedule 1?

What is a schedule B?

What is a Schedule 1 Canada?

Is a Schedule B always required?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file schedule tax?

Any individual who has income that is not subject to withholding tax must file a Schedule Tax. This includes self-employed individuals, freelancers, investors, and other independent contractors.

What is the purpose of schedule tax?

Schedule tax is a form of taxation used by the government to collect money from taxpayers. It is used to fund government services, such as public education, healthcare, infrastructure, and other public services. Schedule tax is a key component of the federal revenue system and helps the government generate the necessary funds to support its operations.

What information must be reported on schedule tax?

Schedule Tax includes information such as your total income, deductions and credits, the amount of taxes owed, and any payments made. It also includes information about any estimated tax payments or refundable credits you may have.

What is the penalty for the late filing of schedule tax?

The penalty for filing taxes late is generally 5% of the unpaid taxes for each month or part of a month that a tax return is late, up to a maximum of 25%. In addition, taxpayers may be subject to a minimum penalty of $135 or 100% of the unpaid taxes, whichever is less.

How to fill out schedule tax?

To fill out your schedule tax, follow these steps:

1. Gather all necessary documents and information: You will need your W-2 forms from all employers, 1099 forms for any self-employment income, interest and dividend statements, as well as any other relevant financial documents.

2. Identify your filing status: Determine your filing status, which could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

3. Enter your personal information: Provide your name, address, and Social Security number(s) as required.

4. Fill out income information: Report your income from various sources, such as wages, salaries, tips, self-employment earnings, interests, dividends, rental income, etc. Ensure you use the correct forms and schedules for each type of income.

5. Claim deductions and credits: Determine if you are eligible for any deductions or credits. Common deductions include student loan interest, mortgage interest, medical expenses, and state and local taxes paid. Popular credits include child tax credit, earned income tax credit, and education-related credits.

6. Calculate your tax liability: Use the tax tables or the tax brackets applicable for your filing status and income level to calculate how much tax you owe.

7. Determine your withholding and payments: Compare the amount of tax you owe to the amount you have already paid through withholding from your paychecks or estimated tax payments. If you have overpaid, you may be eligible for a refund. If you haven't paid enough, you may need to pay additional tax.

8. Complete the necessary forms and schedules: Fill out Schedule A if you plan to itemize deductions instead of taking the standard deduction. Complete Schedule C if you have self-employment income. Fill out any other applicable schedules or forms based on your specific tax situation.

9. Review and double-check: Go through your filled-out forms and schedules, ensuring all information is accurate and complete. Mistakes or missing information can delay processing and potentially lead to errors.

10. Sign and submit: Sign your tax return and mail it to the appropriate IRS address or electronically file it through an authorized e-file provider.

Remember, it's always recommended to consult a tax professional or use tax software to ensure accuracy and maximize deductions and credits.

How do I execute ssa 1699 online?

pdfFiller makes it easy to finish and sign ssa 1699 online form online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I sign the form ssa 1699 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your ssa 1699 online in seconds.

Can I create an eSignature for the ssa 1699 printable in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your appointed representative services form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Fill out your ssa 1699 2013-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Ssa 1699 is not the form you're looking for?Search for another form here.

Keywords relevant to 1699 form social

Related to social security form ssa 1699

If you believe that this page should be taken down, please follow our DMCA take down process

here

.